The price you pay depends on the type of vehicle you’re driving and where you join and leave the M6toll.

Where do I pay?

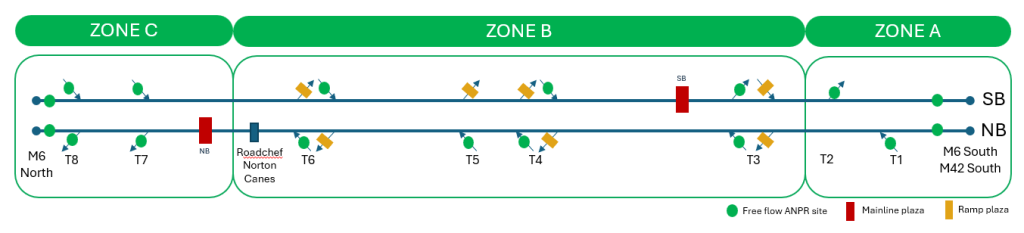

There are main carriageway (‘mainline’) toll plazas between junctions T6 and T7 (northbound), and between junctions T4 and T3 (southbound). If you are exiting at junctions T3, T4, T5 or T6, the (‘junction’) toll plazas are situated just after you leave the main carriageway.

How do I pay?

You need to tap your card/device on the contactless reader as you pass through the toll plaza to open the barrier. Your card issuer will pre- authorise the maximum toll charge for your journey and vehicle classification which will usually show as a ‘pending’ payment in your account.

The final price is normally calculated automatically once you leave the road, please note this can take up to 48 hours if we need to manually check any of the ANPR images. Once the final price has been confirmed, payment will be taken automatically (this may appear as a second transaction) and the pre-authorised amount will be released back to the customer’s account.

Once the price has been worked out, you’ll be able to download a receipt.

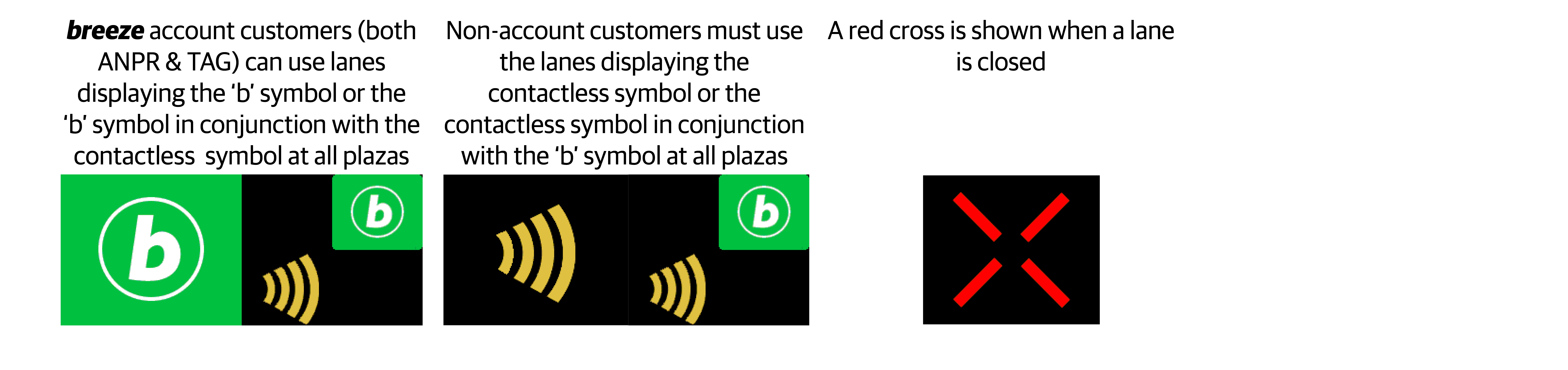

Which lane do I use?

below signage effective from 16th September 2024

Larger vehicles must keep to the left or use the wide load lanes: the barriers will lift automatically if the vehicle has a TAG.

If you have registered your Vehicle Registration Number on your account, you can use any lane, including the breeze lanes with a ‘b’ symbol overhead.

A toll lot simpler

If you are still using a TAG, then why not add your vehicle registration(s) to your online account for extra flexibility? Thanks to our new in-lane cameras, you get all the benefits of a TAG, plus ANPR customers driving a car or van can use any lane at the toll plaza without stopping at the barrier. You can update your vehicle details as often as you like.

It’s easy to register – just log in to your online account or click here for a quick guide

How much will it cost?

You can use our pricing tables or journey planner below to see how much you’ll pay.

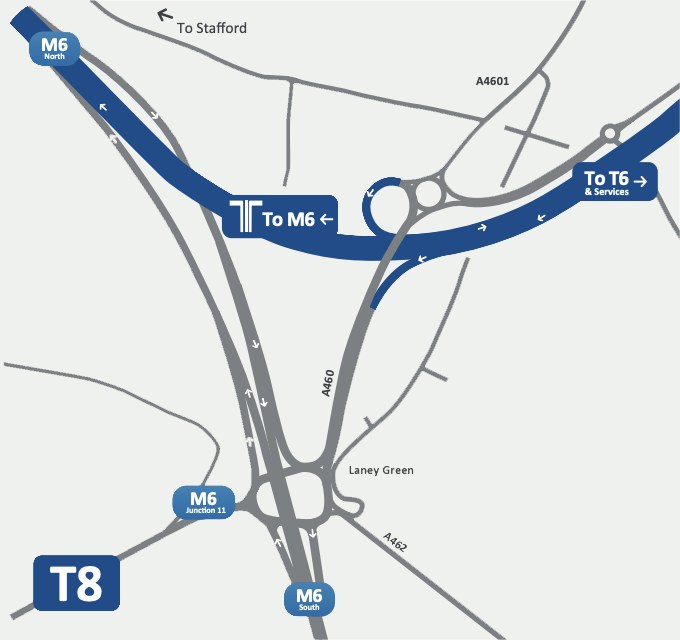

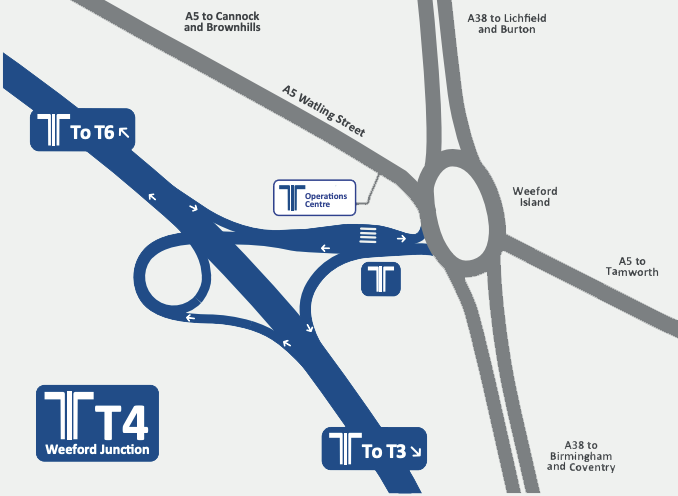

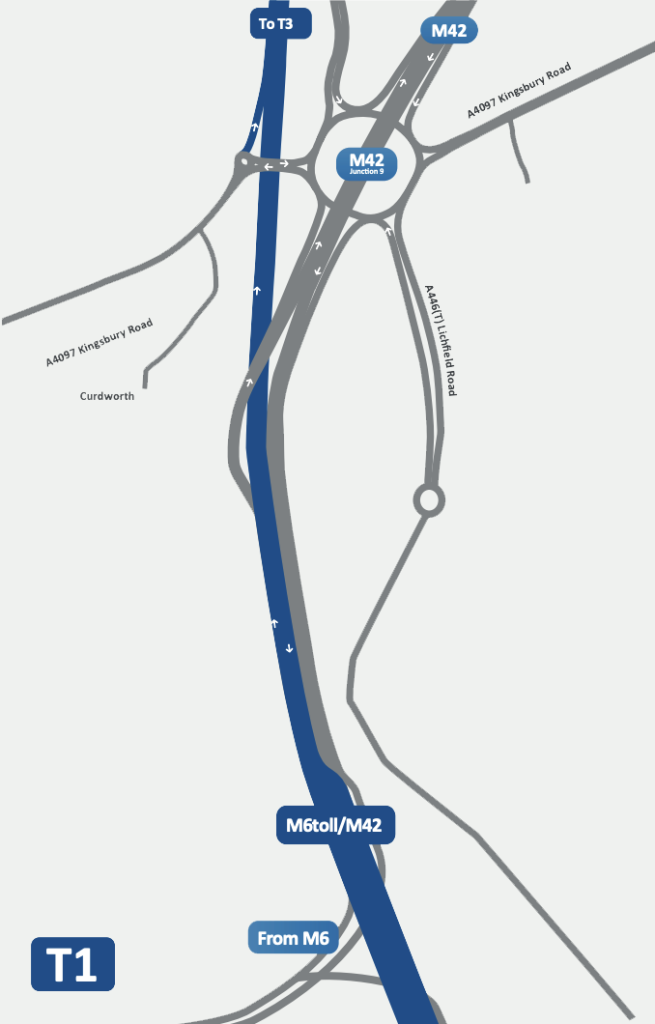

M6toll Junction Map

Click on a junction (T1 to T8) for more detailed maps

Junction T5

Entry point: Northbound only

Exit point: Southbound only

Toll station: On exit

Junction T6

Entry point: Southbound and Northbound

Exit point: Southbound and Northbound

Toll station: On exit

Junction T7

Entry point: Southbound only

Exit point: Northbound only

Junction T8

Entry point: Southbound only

Exit point: Northbound only

Junction T4

Entry point: Northbound and Southbound

Exit point: Northbound and Southbound

Toll stations: On exit

Junction T3

Entry point: Northbound and Southbound

Exit point: Northbound and Southbound

Toll station Southbound: On entry

Toll station Northbound: On exit

Junction T2

No entry point

Exit point: Southbound only

Junction T1

Northbound entry point: From A4097

Southbound entry point: From M42

Exit point: Northbound to M42 only

We’ve divided the road into three zones. Our new, fairer pricing is based on how many zones you pass through on your journey.

It’s a toll lot cheaper with a breeze account

Vehicle Classification

| Vehicle Class | Number of Wheels | Number of Axles | Height | |

|---|---|---|---|---|

| Class One | 2 or less | 0 | Under 1.3m | |

| Class Two | 4 or more | 2 | Under 1.3m | |

| Class Three | 4 or more | more than 2 | Under 1.3m | |

| Class Four | 4 or more | 2 | 1.3m or over | |

| Class Five | 4 or more | more than 2, up to 6 | 1.3m or over | |

We group vehicles into classes based on their size and number of axles, not the type. For example, a typical ‘Class Two’ vehicle has 2 axles and is under 1.3 metres (measuring in line through the centre of the front wheel from the ground to where it hits the top of the vehicle). Taller vehicles, those with more axles or those with additional parts attached (like trailers) will be placed in a different class. These classifications are similar to those used on other toll roads across Europe.

Are you a commercial customer? Discover the benefits of our commercial account, from faster journey times to cheaper running costs.

Heavy Vehicles

The following charges apply to wide and abnormal load vehicles (over 44 tonnes or over 2.9m wide).

| Class | 7 | 8 | 9 | 10 |

|---|---|---|---|---|

| Width in Metres | Over 2.9 – up to 3.5 | Over 3.5 – up to 4.3 | Over 4.3 – up to 5.0 | Over 5.0 – up to 6.0 |

| Price | £35.90 | £53.80 | £126.10 | £341.70 |

Exemptions

In accordance with the Vehicle Excise and Registration Act 1994, we automatically exempt all liveried Emergency Vehicles. All non-liveried Emergency Vehicles should contact Customer Services on 0330 660 0790 for information on the correct procedure prior to using the M6toll.

In accordance with the Armed Forces Act 2006, M6toll grants exemption to members of the regular Armed Forces on duty, vehicles used in military service belonging to the Crown or other vehicles driven by people in the service of the Crown. Ministry of Defence exemption passes can be obtained from your local MT Section. Please do not contact the MOD regarding M6toll MEP applications.

If you have a disability or an organisation which transports people with disabilities, you may be eligible for an M6toll Mobility Exemption Pass.

Exemption from the toll fee will be granted when a vehicle with a Mobility Exemption attached enters the toll plaza and the nominated disabled person is present in the vehicle. If assistance is required, customers should press the call for assistance button, CCTV is in operation to assist with verification.

Please note that the blue badge scheme does not differentiate between those who are entitled to exemption and those who are not. Please include evidence of the applicant receiving one of the below:

To qualify for a Mobility Exemption, the holder must be in receipt of one of the following and provide evidence when making an application:

- A V5 Vehicle Registration Document showing the vehicle registration number and the road tax classification ‘Disabled’

- A confirmation letter to claim vehicle road tax classification status of ‘Disabled’ and vehicle registration number under a Motability Vehicle Lease Agreement

- War pensioner mobility supplement

- Armed Forces Independence Payment.

- Disability Living Allowance (DLA) by virtue of entitlement to the Mobility Component at the Higher Rate.

- Is in receipt of disability assistance for children and young people by virtue of entitlement to the Mobility Component at the Higher Rate.

- Personal Independent Payment (PIP) by virtue of entitlement to the Mobility Component at the Enhanced Rate.

Keep me updated

We’ll be introducing more benefits over the coming months, including discounts and special offers on the M6toll and beyond.

To stay up to date with our latest offers and info, don’t forget to sign up for our emails and follow us on X and Facebook.